eKYC is the electronic customer identification process, which is extremely important for customer service. Let’s learn more about this service in the following article.

eKYC is the electronic customer identification, an activity that associates digital identity with individuals to simplify procedures and documentation, providing convenience for customers. This is an extremely important process for customer service.

eKYC (Electronic Know Your Customer) is a solution for electronically authenticating customers, allowing banks to identify customers 100% online based on biometric information, customer recognition using artificial intelligence, etc., without the need for face-to-face interaction as in the current process.

With the approval of the competent regulatory authorities, many banks in various countries are transitioning from KYC to eKYC, as eKYC represents the digital transformation of KYC.

KYC stands for “Know Your Customer,” which is a process to verify the identity of customers when using banking services such as opening accounts, withdrawing, depositing money, etc. In short, KYC helps banks ensure that customers are legitimate, thereby assessing and monitoring risks, and preventing illegal fraud.

KYC is a solution for verifying customer identities using paper documents and is gradually transitioning to eKYC.

While KYC is carried out at a specific location such as a bank’s counter, eKYC is conducted online, only requiring operations through a smartphone with an internet connection, without the need to directly meet with bank staff.

In addition, eKYC is a fully automated process, carried out based on biometric technology. Depending on the maturity of this technology and the risk control level of each bank, opening an account using eKYC may have different levels of difficulty and ease compared to opening an account at the counter.

In the banking sector, eKYC is only being applied to verify customers when opening new accounts; most other services, such as credit, still require a visit to the counter to complete KYC.

However, eKYC only applies to customer authentication when opening a new account and other services such as credit still require in-person transactions at the counter.

In the age of technology 4.0, eKYC is considered one of the services that banks apply to attract customers. eKYC is a solution to shorten the verification time, save time, costs, and improve the efficiency of bank operations.

2.1. Benefits for users

eKYC helps users minimize time and effort when opening accounts or bank cards via mobile phones without queuing at the counter, time and space limitations.

Additionally, eKYC will establish online identities through electronic methods such as biometric verification, customer identification through AI, cross-referencing personal information with centralized customer identity databases through fingerprint matching on ID cards and actual customer fingerprints.

eKYC allows customer identity authentication through biometric checks and AI customer identification.

With the eKYC solution, customers only need a few minutes for electronic identity verification instead of the normal paper-based identity verification process that could take a long time to wait and fill out forms, documents… Now, users can complete the procedure automatically online, without any manual intervention.

In addition to the benefits for users, eKYC also helps save costs, increase work efficiency, and create better conditions for banks to serve and care for customers.

eKYC is an essential platform for banks to carry out digital transformation in the era of 4.0. Banks in Vietnam are currently competing for market share in digital banking services developed by the banks themselves. As a mini branch on a phone, digital banking apps digitize all activities of traditional banks, including customer identification procedures.

eKYC is an essential platform in the digital transformation process of banks.

The use of electronic identification (EKYC) is the key to performing online identification, comparing customer information with a centralized database. In other words, eKYC helps meet the digitalization criteria for digital banking services.

In addition, eKYC helps banks reduce manpower and personnel costs. eKYC data can be transmitted in real-time without any manual intervention, while taking only a few minutes to verify and issue. This allows banks to reduce labor and personnel costs.

eKYC also helps banks build a unified customer information database. Instead of storing physical records separately in each branch as before, all personal information fields of customers through eKYC are digitized and stored in a common database for all branches.

Checking whether a customer has registered for an account becomes easier, avoiding duplicates as a customer can transact at multiple branches of the same bank.

Security and safety in banking operations are also enhanced thanks to eKYC. Electronic identification operates in a process to ensure that customers conduct real transactions, constantly assess and monitor risks. eKYC allows permanent online storage of all records and data.

Any misuse, improper gains, or illegal activities can be quickly traced back to the customers using that service. This contributes to increasing customer trust in the digital banking services of the banks.

To ensure the highest security for customers, eKYC uses the following security measures:

Use Face ID to verify identity every time you log into your bank account or unlock your smartphone.

With eKYC, customers can verify their identity in just a few minutes. To ensure that the eKYC process meets safety standards, customers should follow the following steps immediately after downloading the bank’s or financial institution’s application.

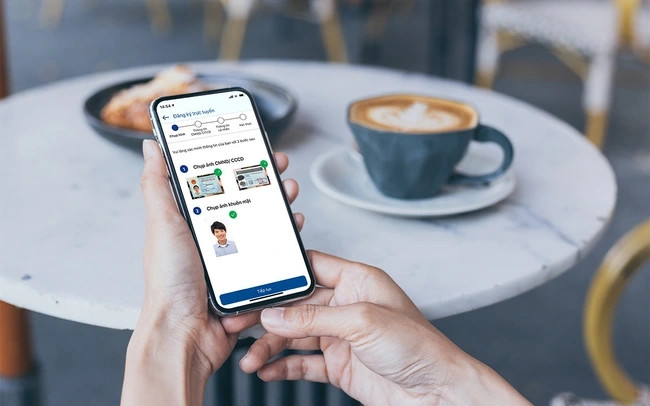

Step 1: Customers fill in all the required information on the application. Then, customers will be asked to choose the documents they want to use for data verification, such as taking pictures of both sides of their passport, driver’s license, or ID card,…

Take pictures of both sides of the ID card on the application after filling in all personal information

Step 2: All customer information will be automatically extracted based on OCR technology, then customers can check and edit it. Next, customers are required to take a selfie photo or a selfie video.

eKYC requires customers to take a selfie photo or a selfie video to verify their identity

Step 3: In case the customer’s image through the selfie video using Liveness detection and Face matching technology matches the image on the provided document, the verification result will be successful. Otherwise, if it fails, customers will have to undergo re-verification.

Face matching is a biometric method based on facial details.

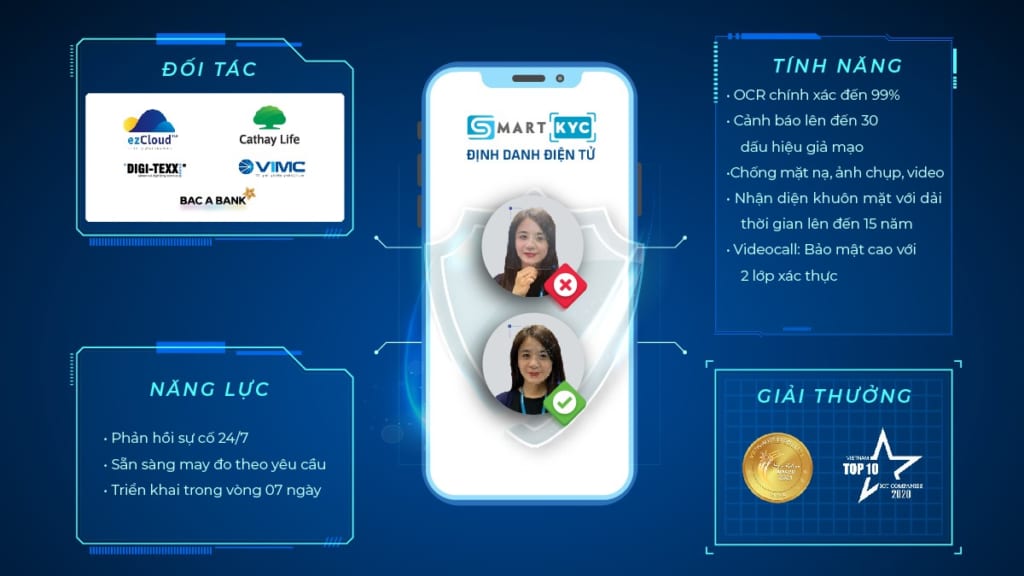

Currently, there are many providers of eKYC electronic identification solutions on the market, but they have not truly excelled. SmartKYC is an electronic identification solution developed by GMO-Z.com RUNSYSTEM based on Artificial Intelligence (AI) technology. SmartKYC possesses many outstanding features and advantages compared to other products on the market

OCR with accuracy up to 99%

OCR with accuracy up to 99%SmartKYC can recognize various types of identification documents for electronic identity verification such as the current 04 types of ID cards, passports, driver’s licenses, etc. Especially under complex photo conditions (handheld photo, glare, low light, etc.), SmartKYC can accurately identify customer information.

There are countless types of document forgery that cybercriminals can carry out, such as forging ID cards (corner-cut documents, fake ID numbers, photocopies), but with SmartKYC, these types of forgery can be completely prevented.

Changes in facial features over time cannot trick SmartKYC. In just 0.3 seconds, SmartKYC can easily identify and compare the matching of two faces. Especially, SmartKYC can easily identify customers on the VIP list, as well as existing blacklists in the system.

Liveness Detection feature

Liveness Detection featureThanks to Passive Liveness, SmartKYC can automatically distinguish whether an image or a video is real or fake. Combined with Active Liveness, in this process, customers will have to perform random actions to prove that they are real.

Especially, the Video Call feature once again helps businesses using SmartKYC completely prevent the possibility of user information forgery. This feature is implemented separately on the website developed by GMO-Z.com RUNSYSTEM.

Furthermore, integrating this feature into the eKYC process flow will comply with the standard of opening accounts by eKYC with a transaction limit of over 100 million VND/customer/month. This will definitely be an advantage to help businesses satisfy their customers and enhance their product usage experience.