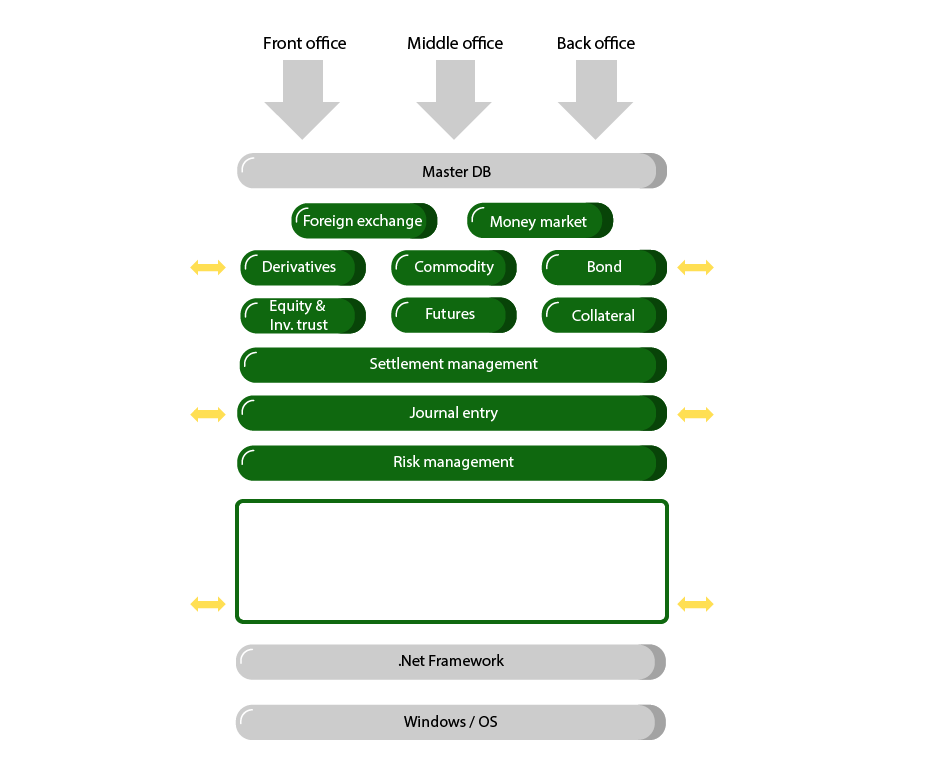

Trade entry, trade approval, linkage management with other products, period management

Foreign exchange, money market, IR derivatives, FX derivatives, commodity, bond, OTC bond option, equity, investment trust, listed futures, listed options, collateral

Position management, profit and loss valuation, mark-to-market valuation

Portfolio management, exposure valuation, credit line management, Value at Risk valuation, back-testing, PnL simulation

Discover how our customer successfully digitize their businesses with GMO-Z.com RUNSYSTEM