eKYC - Electronic Customer Identification: The "Golden Key" of Digital Banking

The Digital Transformation Race Among Banks

Over the past two years, numerous banks in Vietnam have undergone digital transformation, launching super apps and especially implementing eKYC (electronic Know Your Customer) – electronic customer identification.

According to a report by FnF Research, the global eKYC (electronic Know Your Customer) market was estimated at USD 257.23 million in 2019 and is projected to reach USD 1,015.36 million by 2026, with a compound annual growth rate (CAGR) of up to 22% from 2019 to 2027.

Regarded as the gateway to digital banking, eKYC offers a comprehensive and continuous customer identification solution between users and financial institutions or banks.

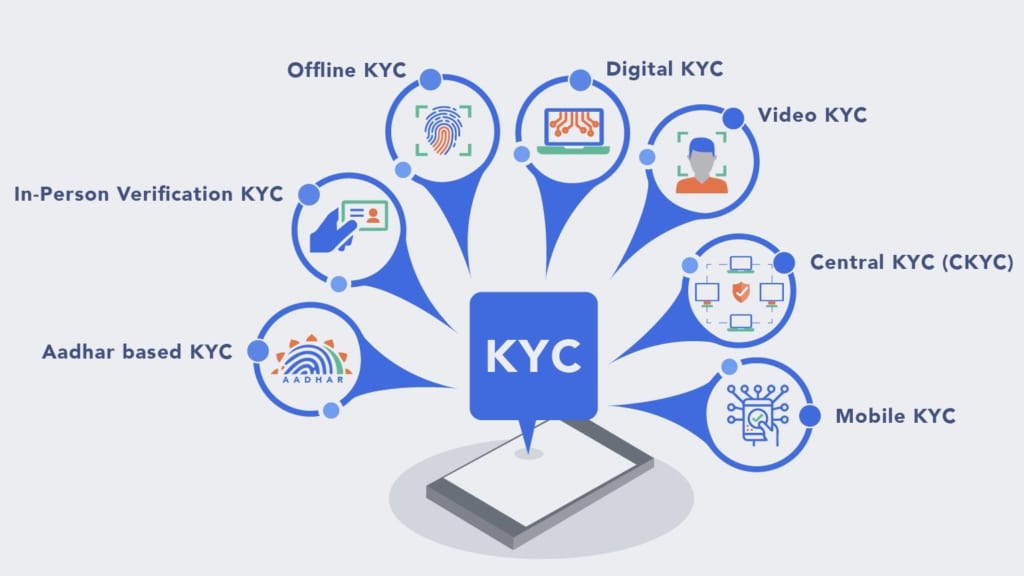

Instead of face-to-face meetings and verifying identity documents, eKYC remotely identifies customers electronically through technologies like biometric authentication, AI-powered facial recognition, and cross-checking personal information with centralized customer identification databases.

Rather than standing in long queues or filling out multiple forms and documents, eKYC speeds up services through appropriate recognition and routing, meeting the customer’s transaction needs effectively.

Fully automated, eKYC significantly reduces verification time and operations to just a few minutes. This not only saves time for customers but also helps banks reduce operating costs.

Leading with Advanced Technological Foundations

According to the 2019 Vietnam ICT Readiness Index (ICT Index 2019), BIDV consistently ranked first among commercial banks in ICT Index from 2017 to 2019, and led in IT development and application readiness.

Over time, BIDV has carefully prepared its technology and operational processes to implement eKYC, while investing in building a robust biometric system to apply widely across customer groups.

According to BIDV, its upcoming technology platform will be capable of handling various needs such as: customer identification and authentication across digital channels, ATMs, self-service systems (eZone), and transaction terminals; expanding customer reach; increasing banking transactions by authenticating customers via systems connected with the bank (e.g., hospitals, insurance, taxation), and enabling verification through agent banking networks once authorized.

BIDV's digital transformation campaigns mark significant progress in efforts to enhance customer service. The bank is currently digitizing its customer base, with over 50% of individual clients under 35 years old.

Since its launch on March 20, 2021, more than 20,000 users have experienced the eKYC feature, highlighting the market’s growing demand for digital solutions. The bank has also partnered with 30 out of 41 fintech companies, offering over 2,000 payment and shopping services on its SmartBanking app.

Additionally, new customers signing up for the service now receive a welcome gift of 50,000 VND, along with attractive offers and a chance to win a car worth over 20 billion VND in total.

With major advantages in customer portfolio, IT application capabilities, and a strong commitment to breakthrough growth, BIDV aims for 80% of its customers to access and use digital channels by 2025.

Banking digitization brings significant value to the financial sector, banks, and customers: enhancing customer experience; improving operational quality and service capacity; creating more convenient products and services; strengthening security and reducing costs.

———————————

Smart Solutions – Digital Transformation Solution Ecosystem

Digital Transformation Division of GMO-Z.com RUNSYSTEM

Website: https://ssolutions.vn/

Hotline: 097 583 0096

Location: Hanoi – Hue – Da Nang – Ho Chi Minh City – Tokyo