SmartKYC.eID

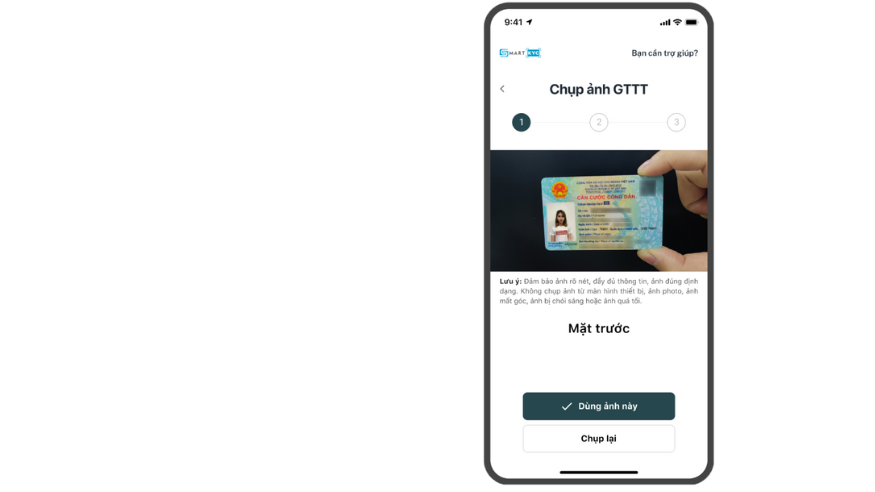

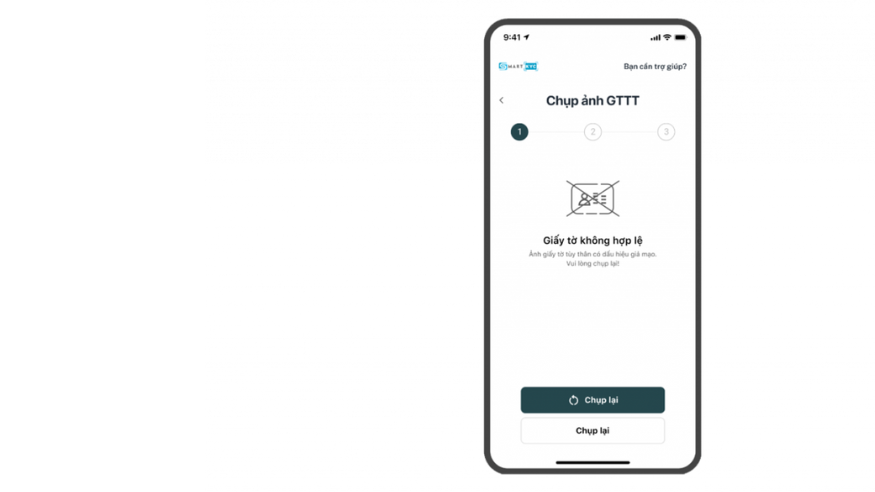

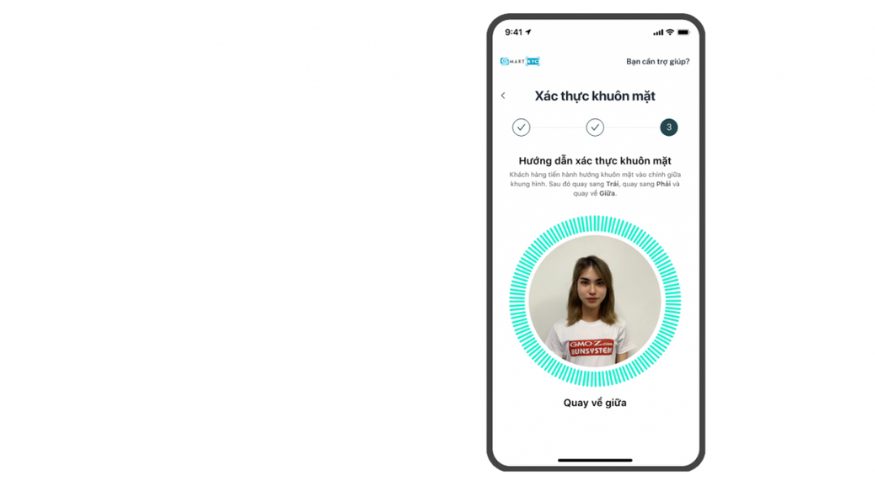

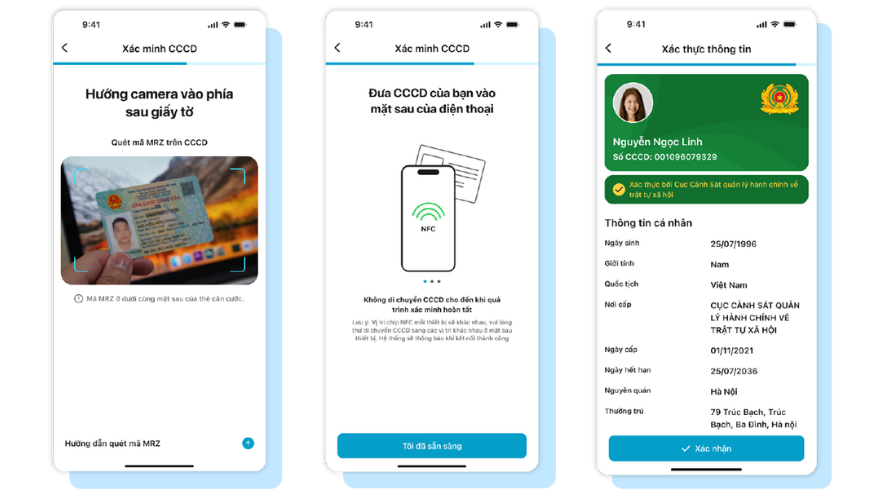

SmartKYC is a comprehensive digital solution for customer identification, helping to optimize resources in customer identification. At the same time, it supports centralized customer data management, an optimal KYC identification process helps to improve customer experience.

Business Challenges

Features (USP)

Client Success Stories

Discover how our customer successfully digitize their businesses with GMO-Z.com RUNSYSTEM

Featured Projects

SmartKYC is deployed in On-Premise form. The system brings higher control and security to businesses, especially for the Finance - Banking industry with high requirements.

SmartKYC is especially suitable for finance, banking, securities and businesses that need to identify customers.

SmartKYC has the ability to connect and integrate flexibly with systems such as Core Banking, Omni Channel (Mobile banking and internet banking), CRM system. The system uses API methods (RESTful API, SOAP API); Webhooks; SDK / Mobile SDK...

Please leave your information in the form to receive advice and detailed quotes from our experts.