SmartKYC Integrated into Account Onboarding Process at Thien Viet Securities

Thien Viet Securities Joint Stock Company (TVS) is one of Vietnam’s leading investment banks, offering a full range of services to clients nationwide. With the ambition of becoming Vietnam’s top-tier investment bank and building a comprehensive financial platform tailored to clients’ needs, TVS continuously seeks out advanced technological solutions to enhance operations and optimize customer experience.

The Challenge Faced by TVS

In recent years, the booming stock market has led to a surge in demand for securities account openings. However, the outbreak of COVID-19 made it extremely difficult for investors to complete account registration at physical branches. In 2021, eKYC (electronic Know Your Customer) emerged as a breakthrough solution, enabling users to open accounts remotely and securely within minutes. Today, over 90% of securities firms in Vietnam have adopted eKYC as a standard, no longer a competitive advantage, but an industry necessity.

Aware of this market shift, TVS began searching for a trusted eKYC provider in late 2021, aiming to digitize its account opening process while ensuring seamless customer experience and operational quality—even with high volumes of account requests. After evaluating several providers, TVS placed its trust in GMO-Z.com RUNSYSTEM’s SmartKYC solution to power their onboarding transformation.

SmartKYC – Advanced eKYC Solution for Digital Customer Onboarding

SmartKYC – One of the Most Advanced eKYC Solutions in Vietnam

SmartKYC is an AI-powered electronic customer identification solution developed by GMO-Z.com RUNSYSTEM. It features a 99% OCR accuracy rate, detects over 30 types of document fraud, and defends against spoofing via masks, photos, and videos.

As online fraud becomes increasingly sophisticated, SmartKYC stands as a powerful barrier, capable of thwarting a wide range of forgery tactics. Even against numerous fake document formats and deepfakes, SmartKYC consistently ensures security and authenticity.

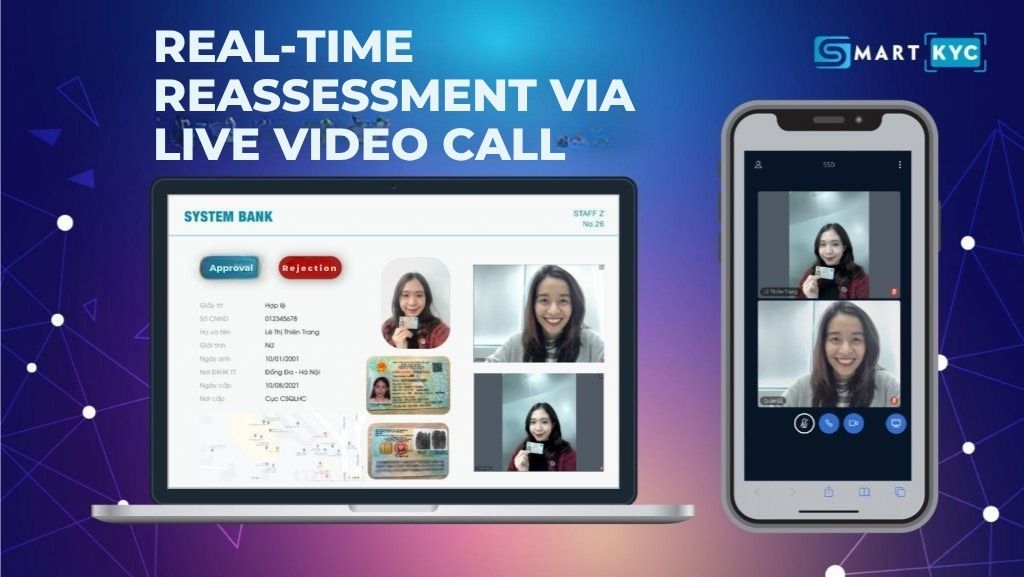

SmartKYC’s Video Call Feature Enhances Anti-Fraud Capabilities

By adopting SmartKYC, TVS empowers users to open accounts securely from anywhere within just five minutes — no need for physical visits or long approval waits. Beyond enhancing customer convenience, SmartKYC also streamlines internal operations, reduces costs, and boosts overall productivity for TVS.