eKYC: Enhancing User Experience for Banks

User experience in eKYC plays a crucial role in helping banks create positive impressions and retain customers. So how can banks optimize the user experience during the eKYC process? Let’s explore SmartKYC – an eKYC solution designed to deliver a seamless and user-centric onboarding experience.

Challenges of eKYC in User Experience

eKYC (Electronic Know Your Customer) is a digital identity verification solution that enables banks to authenticate customer identities quickly and accurately. It serves as the first point of contact between the bank and potential customers who are looking to use its services. Therefore, delivering a smooth and hassle-free experience during the identity verification stage is essential.

However, in practice, many users face challenges during the eKYC process. The common reasons include:

- A significant proportion of users are first-time eKYC users. With limited knowledge of technology and how the process works, they often struggle with the steps involved.

- Even minor issues such as accidental rejections, slow response times, or having to repeat actions multiple times can lead to frustration. This can result in users abandoning the process midway, causing banks to lose potential customers just before successful onboarding.

SmartKYC: A User-Centric eKYC Solution for Banks

To overcome the challenges mentioned above, banks need an eKYC solution that prioritizes and enhances the user experience. SmartKYC is a leading eKYC platform that offers numerous benefits for both banks and their customers, including:

- Advanced Optical Character Recognition (OCR) Technology:

SmartKYC leverages cutting-edge OCR capabilities to accurately process information under various environmental conditions. Its OCR feature allows customers to complete identity verification anytime, anywhere, whether they are in an office, at home, or outdoors. Furthermore, SmartKYC supports a wide range of document types beyond the standard four types of national ID cards, offering unmatched flexibility.

- User-Optimized SDK Design:

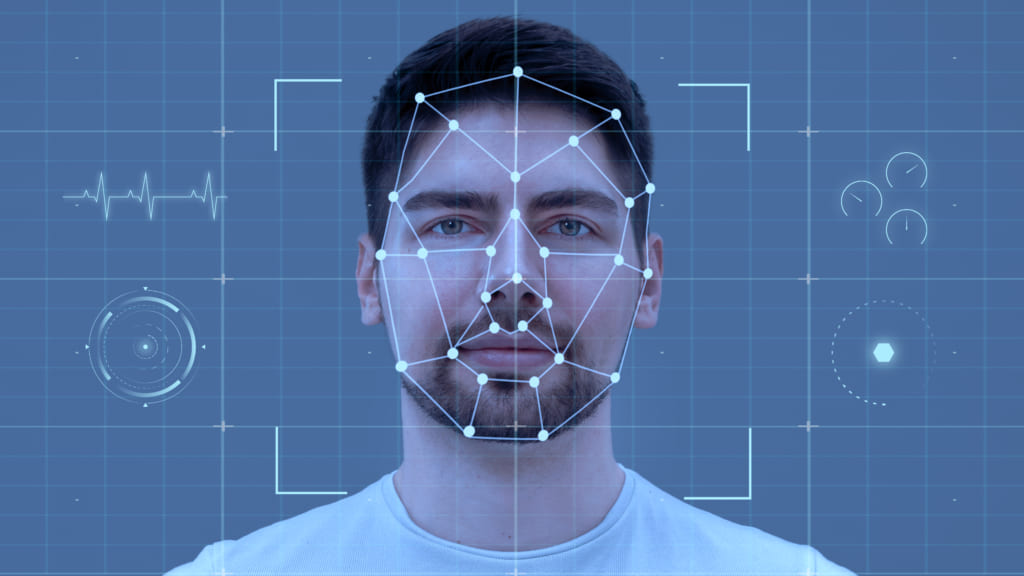

The SmartKYC SDK is built with a strong focus on optimizing every step of the user journey, from capturing ID documents to performing liveness detection. The user interface is designed to be intuitive, with clear and visually friendly instructions that make each step easy to understand and follow. Additionally, the system ensures rapid response times between steps. On average, a full eKYC flow takes only 20 to 30 seconds, making the process fast, smooth, and user-friendly. Face Liveness: Combining Passive and Active Techniques for Enhanced Security

SmartKYC uses a combination of passive liveness and active liveness detection to verify the authenticity of a customer’s face. With passive liveness, SmartKYC analyzes biometric features such as iris patterns and subtle facial movements to detect and reject deepfake attempts.

Meanwhile, active liveness prompts users to perform a series of random actions, such as looking straight ahead, turning their head left or right, or smiling to counteract spoofing attacks using printed photos or pre-recorded videos.

Conclusion

eKYC is a powerful solution that enables banks to verify customer identities quickly and accurately. However, it can also present challenges, especially for first-time users who may find the process unfamiliar or complicated.

With SmartKYC, banks can provide an optimized and secure user experience from the very first step of onboarding. Don’t let a poor eKYC journey cost you valuable customers. Choose SmartKYC today.

———————————

Smart Solutions – A Comprehensive Digital Transformation Ecosystem

Digital Transformation Division of GMO-Z.com RUNSYSTEM

Website: https://ssolutions.vn/

Hotline: 097 583 0096

Locations: Hanoi – Hue – Da Nang – Ho Chi Minh City – Tokyo