GMO-Z.com RUNSYSTEM successfully deploys electronic identification solution SmartKYC for PG Bank

PG Bank and the Challenge of Applying Technology to Upgrade Service Processes

Petrolimex Group Commercial Joint Stock Bank (PG Bank) is one of the banks that has made remarkable progress in both scale and efficiency in recent years in Vietnam. Aiming to become a leading multifunctional commercial bank, PG Bank has always recognized the essential importance of applying technological platforms in its operations and business processes. In recent years, PG Bank has continuously launched various online banking services, mobile banking apps, and enabled customers to conduct most transactions digitally… Especially, the outbreak of the pandemic has acted as a catalyst, accelerating the wave of technology adoption for digital transformation in the Finance – Banking sector in general and PG Bank in particular. A standout trend is online account opening and customer identification.

Quickly Recognizing Changes in Market Demand

The emergence of the pandemic has exposed existing limitations in traditional identification processes. As a result, electronic Know Your Customer (eKYC) with features such as anti-spoofing, accurate identification, and fast processing has become a highlight and a competitive advantage helping the bank transform the market landscape. Early recognizing changes in consumer needs and market trends, since early 2021, PG Bank began planning to seek and select eKYC solution providers as part of its strategy to create a competitive advantage through better customer experiences.

SmartKYC: Fast, Accurate Customer Identification – Blocking All Fraudulent Acts

Among the eKYC solution providers in the market, PG Bank trusted and selected SmartKYC by GMO-Z.com RUNSYSTEM to implement an online bank account opening process. The SmartKYC electronic identification solution is developed by GMO-Z.com RUNSYSTEM based on artificial intelligence (AI). SmartKYC offers outstanding features such as:

Optical Character Recognition (OCR) technology that recognizes printed text and card lines with up to 99% accuracy.

Fraud Check technology, alerting up to 30 signs of forged personal documents.

Liveness technology capable of detecting 2D masks, photos, videos… helping the Bank eliminate most fraudulent and exploitative behaviors.

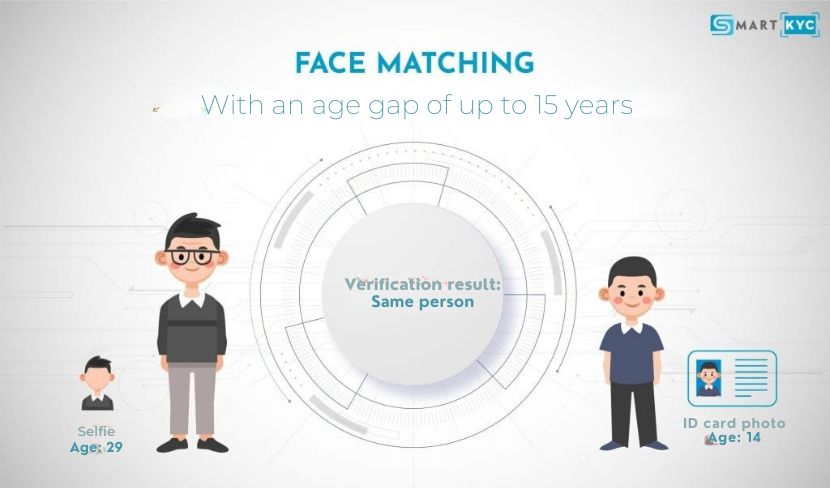

Face Matching technology compares facial similarity with ID documents, allowing superior face recognition with a time range of up to 15 years.

By applying SmartKYC, PG Bank provides customers with a fast, convenient, and secure way to open an account. Instead of visiting a branch or submitting an online request and waiting for approval, customers can now open a bank account from home at any time within just 1 minute. Beyond optimizing customer experience, SmartKYC also helps streamline business operations, reduce costs, and enhance employee productivity at PG Bank. Implementing eKYC is one of the first steps laying the foundation for PG Bank’s digital transformation journey. For GMO, this is considered the kickoff to a long-term strategic partnership with PG Bank. With a mission to support Vietnamese enterprises in digital transformation, GMO is committed to continuously supporting and accompanying PG Bank in future projects. Currently, 90% of financial institutions have implemented eKYC. If your organization is still looking for an eKYC solution, contact us now to receive a 2-month free trial of SmartKYC. Website: https://ssolutions.vn/ Fanpage: Smart Solutions – Digital Transformation Solutions Hotline: 097 583 0096