How OCR Technology is transforming Big Data in the finance and banking industry

The Finance and Banking industry is known for its strict regulations regarding data management and processing. To optimize the management of large volumes of data while ensuring accuracy, modern financial institutions are turning to Optical Character Recognition (OCR) technology. Let’s explore how OCR has revolutionized Big Data in the finance and banking sector through the article below.

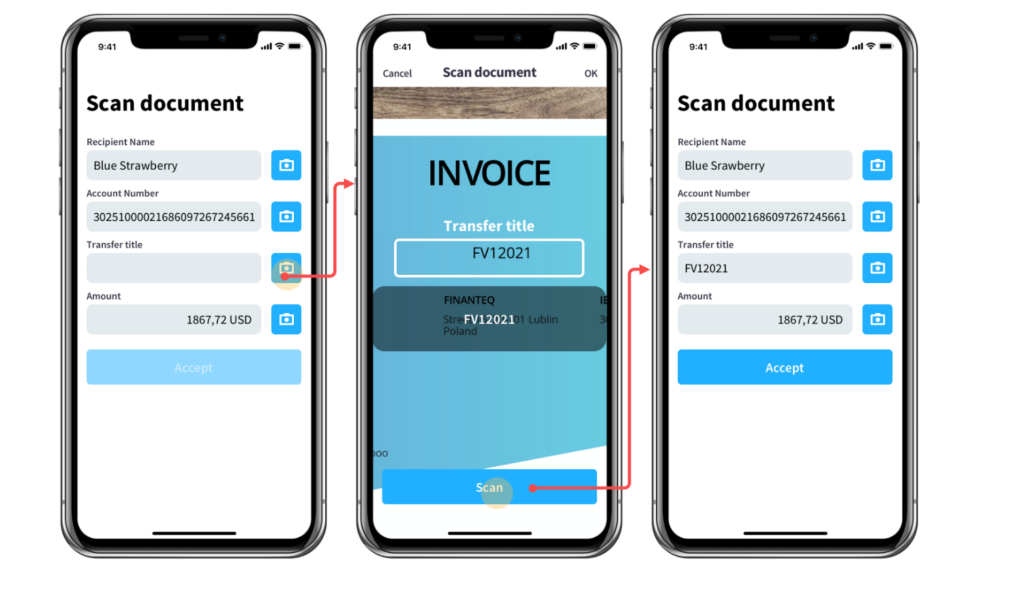

In the past, storing information in digital format required significant manual effort and was time-consuming. Staff or customers had to manually input each data field — often resulting in errors, especially with long numeric fields like document IDs, invoice numbers, or ID card numbers. By using OCR technology to automatically recognize text and convert it into machine-readable, searchable, editable, and storable digital characters, businesses have transformed a cumbersome, manual process into a fast, accurate, and fully automated workflow.

1. Enhancing the Quality of Big Data Repositories with OCR Technology

OCR allows for the optimization of big data models by converting printed text, paper documents, and images into digital files that can be read, edited, and searched by machines. These digital files are then stored in Big Data repositories. Without digitized data, it would be impossible to automate the extraction and processing of valuable information.

For financial and banking organizations, OCR Studio software can now read and extract specific data fields from bank statements, contracts, and other critical documents based on the enterprise’s requirements. Currently, each financial institution typically needs 20–25 staff members working full-time shifts just to manually digitize paper documents. This manual data entry not only consumes excessive time and resources but also carries a high risk of input errors.

Instead of wasting valuable human resources on such inefficient processes, organizations can use OCR to automate data entry from the start. With a properly designed and implemented OCR model, businesses can ensure a “clean” data source from the beginning—one that is easy to edit and synchronize later if needed. Most importantly, this systematically organized data becomes easier to manage and reuse within the company’s Big Data infrastructure.

2. OCR Supports Regulatory Compliance in Financial and Banking Services

Handling large volumes of personal and sensitive data, banks and financial institutions must strictly adhere to legal regulations and undergo rigorous audits by compliance bodies and auditing firms. As a result, these companies are required to effectively manage and securely store financial records in a consistent and standardized manner.

During audits, manually sorting through thousands of paper documents to retrieve specific information is extremely time-consuming and costly — and so is the physical storage of these documents. According to research conducted by PricewaterhouseCoopers, an organization on average spends $20 to file a document, around $120 to locate a misfiled document manually, and $220 to reproduce a lost document.

Current document scanning processes typically only convert paper documents into image files stored on computers. These scanned images cannot be searched, edited, or extracted into digital text. To overcome this limitation, advanced OCR tools have emerged, enabling businesses to easily convert physical documents into editable, searchable digital formats with just a few clicks.

As a result, banks and financial institutions can significantly reduce document storage costs, standardize document management workflows, and streamline information presentation during audits.

With a well-organized and efficiently managed Big Data repository, businesses can ensure data governance compliance according to legal regulations. At the same time, since the data entry process is fully automated, companies can minimize the number of personnel granted access to sensitive data, thereby strengthening data security and confidentiality across the enterprise.

3. OCR Technology Helps Optimize Enterprise Resources

Manual data entry has long been a repetitive, time-consuming task that drains valuable human resources in Financial and Banking institutions. OCR tools equip businesses with the ability to standardize data input processes through full automation, significantly reducing labor and material costs. This allows organizations to reallocate resources to more specialized, high-value tasks aligned with their core financial and banking operations.

At the same time, OCR software eliminates the need for additional investments in ineffective data management and reading tools, ensuring that enterprise resources are directed toward the most productive and strategic outcomes.

4. OCR Studio – A Leading Document Digitization Solution for Banks

With features that allow automatic extraction and population of data into predefined fields, OCR technology is extensively applied in the field of document digitization. At GMO-Z.com RUNSYSTEM, our team of top-tier experts in both Economics and Technology has developed an intelligent document digitization solution — OCR Studio.

This solution helps banks digitize paper-based records with an accuracy rate of up to 99%, ensuring cost savings, time efficiency, and the highest return on investment for financial institutions.

99% Accuracy — The Market Leader in Handwriting Recognition

Not only does OCR Studio ensure accurate recognition of printed text from well-preserved documents, it is the only solution on the market capable of recognizing complex elements such as stamps, signatures, checkboxes, and even handling noisy backgrounds caused by colors, stamps, and tables.

Most notably, OCR Studio stands out as the only solution in the market that can accurately process handwritten Vietnamese text, making it highly applicable to real-world enterprise workflows.

Flexible Data Extraction – Tailored to Your Business Needs

OCR Studio can extract fields based on user-defined requirements and supports post-validation of data. Even non-technical users can easily define custom fields for extraction. The built-in App Store offers 50+ pre-configured document templates for instant use, eliminating the need for manual setup.

In addition, OCR Studio offers unique features not available from any other provider on the market:

- Dictionary Support: A data normalization tool for processing specific fields.

- Data Sync Standards: Seamless integration with ECM systems and other data platforms.

- Asynchronous Document Processing: For enterprises with massive document volumes, OCR Studio allows bulk uploads and supports asynchronous extraction to ensure smooth handling.

Proven Delivery Capability

With 20 years of experience in software development and IT solutions across Vietnam and Japan, we confidently deliver high-quality solutions backed by exceptional customer support. OCR Studio has earned the trust of major clients, including:

- Shinhan Bank

- SeABank (Southeast Asia Commercial Joint Stock Bank)

- Cathay Vietnam Non-life Insurance

Toyota Finance, among others.

📌 See how Shinhan Bank accelerated customer document processing with OCR technology

Contact Us

If you're interested in exploring this solution, contact our team of experts for a tailored consultation.

📍 Smart Solutions – Digital Transformation Ecosystem

Digital Transformation Division, GMO-Z.com RUNSYSTEM

🌐 Website: https://ssolutions.vn

📘 Facebook: https://www.facebook.com/ssolutions.dx

📞 Hotline: 097 583 0096

📍 Offices in: Hanoi – Hue – Da Nang – Ho Chi Minh City – Tokyo