OCR application saves time in bank loan processing

Bank loan processing (bank advance) is one of the most time-consuming and procedurally complex workflows. Nowadays, many businesses have adopted OCR (Optical Character Recognition) technology to automate and accelerate the process. So, what exactly is OCR technology, and how does it help reduce the time required to process bank loan applications? Let’s explore this with SSD in the article below:

1. Challenges in Bank Loan Application Processing

Bank advance is a general term referring to loans provided by banks. In the UK, this term is typically limited to overdrafts and short-term disbursements for various purposes. However, in many other countries—where bank lending is often carried out through bill discounting—the use of this term may encompass a broader range of bank loan types.

Challenges in the Bank Loan Application Process

To complete a loan application, there are typically four main steps:

- Step 1: Receive application documents

- Step 2: Process the loan documents

- Step 3: Evaluate and approve the loan

- Step 4: Disburse the funds

Among these, the most time-consuming task is loan document processing. A loan application typically includes a wide variety of documents such as: loan request forms, identification papers, financial reports, land use right certificates (e.g., red book), and more. Before evaluation and approval, banks must process and input hundreds of data points—ensuring 100% accuracy.

With the increasing number of banks and financial lending institutions, customers expect their applications to be approved instantly. However, according to a study by Ellie Mae, lenders still take an average of 52 days to manually process a mortgage—from the submission date to the disbursement of the loan.

To address this, banks are increasingly turning to AI technologies, with Optical Character Recognition (OCR) leading the way, to automate manual tasks and significantly reduce processing time.

OCR Technology Solution – Minimizing Loan Application Processing Time

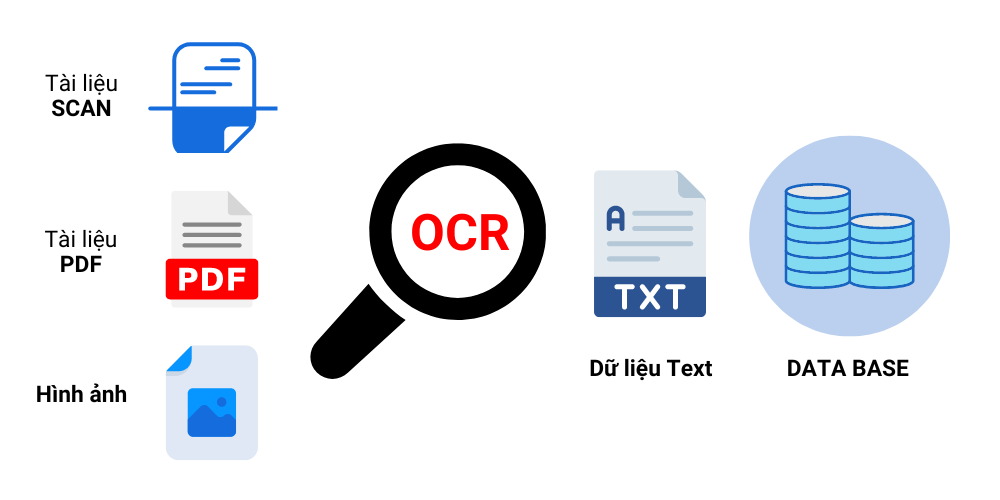

OCR (Optical Character Recognition) is a technology that converts characters from images or PDF files into machine-readable text formats. OCR is widely recognized as a tool that specializes in identifying and reading text, extracting relevant information, and storing it as digital data—helping to digitize documents efficiently.

OCR Technology Enhanced by Artificial Intelligence (AI)

OCR technology, enhanced by artificial intelligence (AI), is capable of extracting information into usable electronic data. Whether a loan application is submitted as a physical document or uploaded online as an image or PDF file, OCR software can handle it—completely replacing repetitive manual tasks performed by humans.

The various forms included in loan applications can be quickly recognized and accurately extracted within seconds. This not only saves processing time but also ensures high accuracy while minimizing common risks and errors typically found in manual workflows. As a result, the loan application process becomes simpler, the disbursement timeline is shortened, and customer satisfaction is significantly improved.

3. OCR Studio – A Leading Document Digitization Solution for Banks

With its ability to automatically extract and populate information into predefined data fields, OCR technology is extensively applied in the field of document digitization. At GMO-Z.com RUNSYSTEM, our team of top experts in Economics and Technology has developed OCR Studio—an intelligent document digitization solution designed specifically for high-demand sectors like banking.

OCR Studio helps banks digitize physical documents with up to 99% accuracy, effectively reducing operational costs, saving time, and delivering maximum return on investment. Especially in bank loan processing, OCR Studio offers powerful capabilities such as:

- Comprehensive document handling across various file types within loan application packages

- OCR accuracy of up to 99%

- Market-leading recognition of handwritten and Vietnamese text

- Ability to detect and process unusual symbols, checkboxes, strikethroughs, stamps, and more

- Reduces bank loan processing time by up to 90%

With OCR Studio, banks can transform their loan processing workflows—making them faster, more reliable, and customer-friendly.

With 20 years of experience in software development, providing IT solutions and services for both the Vietnamese and Japanese markets, we are confident in delivering high-quality solutions along with the most dedicated customer support. Our OCR Studio document digitization solution has earned the trust of hundreds of major partners, including Shinhan Bank, Southeast Asia Commercial Joint Stock Bank (SeABank), Cathay Vietnam Non-life Insurance Co., Ltd., Toyota Finance, and many more.

🔍 Discover how Shinhan Bank accelerated its customer document processing with OCR technology.

If you're interested in our solution, please contact us using the information below to receive consultation from our team of experts.

Source: Compiled information

————————

Smart Solutions – A digital transformation solution ecosystem

Digital Transformation Division – GMO-Z.com RUNSYSTEM

🌐 Website: https://ssolutions.vn/

📘 Facebook: https://www.facebook.com/ssolutions.dx

📞 Hotline: 097 583 0096

📍 Locations: Hanoi – Hue – Da Nang – Ho Chi Minh City – Tokyo