SmartKYC: Effective anti-counterfeiting eKYC solution for financial institutions

Online Identification – A Favorite Channel for Scammers

Recently, many users of financial and banking services have received SMS messages containing phishing links, requesting personal information, credit card details, or prompting withdrawals. These are scams where fraudsters impersonate banks to steal customers' assets. Many financial institutions and banks have warned customers about these tricks and advised against clicking links or revealing sensitive information. This is one example of the growing issue of financial crime in recent years.

With the nature of holding sensitive financial data, the banking industry constantly faces identity fraud at every customer interaction point. According to our statistics, up to 90% of all daily account opening requests via online channels are invalid. To cope with this, banks have had to implement eKYC systems while also maintaining a costly manual verification team.

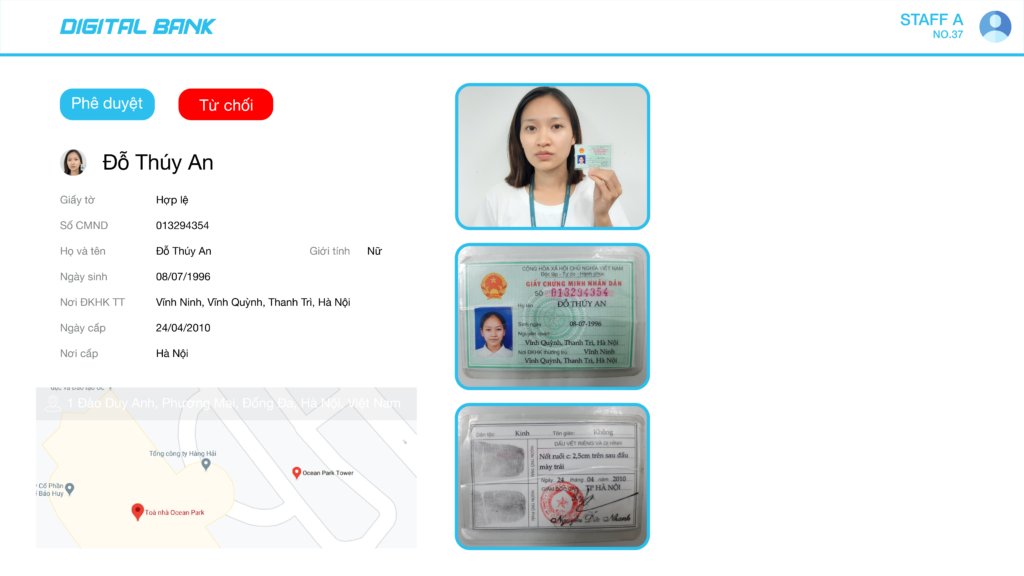

SmartKYC is an eKYC solution researched and developed for nearly 10 years by GMO-Z.com RUNSYSTEM. Built on artificial intelligence (AI), SmartKYC helps automate the bank’s identification process with high accuracy and reliability. The development team brings extensive implementation experience in banking and securities companies. We closely monitor the market and listen to customer needs to quickly detect scam tactics and provide accurate and effective solutions.

SmartKYC's Impressive Anti-Fraud Capabilities

Ability to Detect Up to 34 Types of Fraud

SmartKYC can detect up to 34 types of fraud in online identification, including highly sophisticated cases such as: photographing ID documents through a screen, replacing/photoshopping ID photos, using color photocopies, and applying advanced technologies like deepfake to create fake facial images. These can even bypass manual inspection.

Three-Layer Security Barrier

To bypass SmartKYC, fraudsters must succeed in penetrating multiple layers of security:

- The first layer checks the validity of input data. This ensures ID photos have enough angles, complete information, and clarity.

- The second layer verifies logical consistency among information fields. According to the Ministry of Public Security, an ID number must follow certain rules that reflect personal information. Verifying field consistency restricts fraudsters from modifying data on the ID.

- The third layer detects signs of tampering. Any attempt to edit, insert, delete, or photoshop original ID content will be easily detected by SmartKYC’s AI.

Ensuring a Smooth Identification Experience for Users

Despite its sensitivity to fraud, SmartKYC maintains a suitable threshold to allow genuine customers to identify themselves with ease. This is thanks to its advanced AI technology that accurately distinguishes between real users and fraudsters.

Banks can lose 10–15% of potential customers due to false rejections. This is no longer a concern with GMO’s SmartKYC solution.

Benefits of SmartKYC

By using SmartKYC, financial institutions gain multiple benefits, including:

- Enhancing financial security for customers and institutions, protecting against fraud and scams.

- Saving time and post-verification resources, reducing costs and legal risks.

- Improving service quality, increasing customer satisfaction and trust.

- Expanding business opportunities, reaching new markets and potential customers.

Conclusion

SmartKYC is an optimal eKYC solution that helps financial institutions effectively prevent identity fraud while saving time and post-verification resources. If you're interested in SmartKYC, contact GMO for detailed consultation and support. GMO is a leading provider of eKYC solutions for financial institutions in Vietnam. We are committed to delivering high-quality, secure, and effective products and services.