Easily digitize bank statements with OCR Technology

Processing bank statements is a complex procedure that requires a great deal of time and meticulous attention due to the large volume of data and figures involved. The development of OCR (Optical Character Recognition) technology has enabled businesses to digitize documents and records, effectively overcoming the limitations of traditional manual methods.

1. Challenges in Processing Bank Statements for Businesses

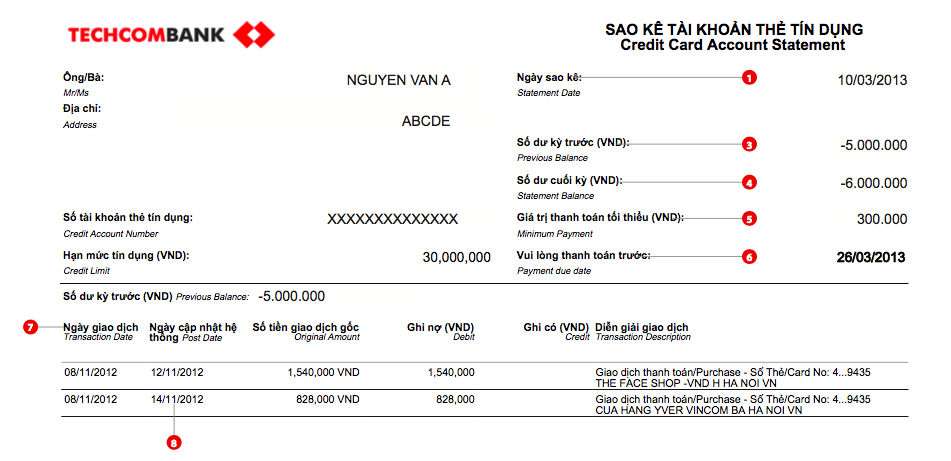

A bank statement is a detailed record of all transactional activities that affect the balance of a personal or organizational payment account. The statement provides accurate information about the time and amount of each transaction. Statement periods usually cover one month or less, depending on the customer's request.

The bank statement is issued either in physical paper format (in traditional bank statement methods) or as a PDF file (in digital banking methods). A statement is typically displayed in a table format, containing a large volume of detailed information and long numeric sequences, often in a non-editable format (image or PDF).

With traditional processing methods, businesses must manually input the required data fields, then cross-check and store the data. This manual approach consumes significant time, incurs high operational costs, and slows down overall productivity.

Moreover, human errors during data entry are nearly unavoidable, posing potential data risks to the business. Since bank statements include highly critical financial information and data flows, accuracy is paramount. As a result, businesses may spend hours manually entering and verifying data from just a single batch of documents. When dealing with a high volume of documents, this method becomes increasingly inefficient and impractical.

In this context, AI-powered bank statement processing has emerged as a viable solution. It helps businesses eliminate repetitive manual data entry and significantly boosts operational efficiency.

2. Applying OCR – A Smart Solution for bank statement processing

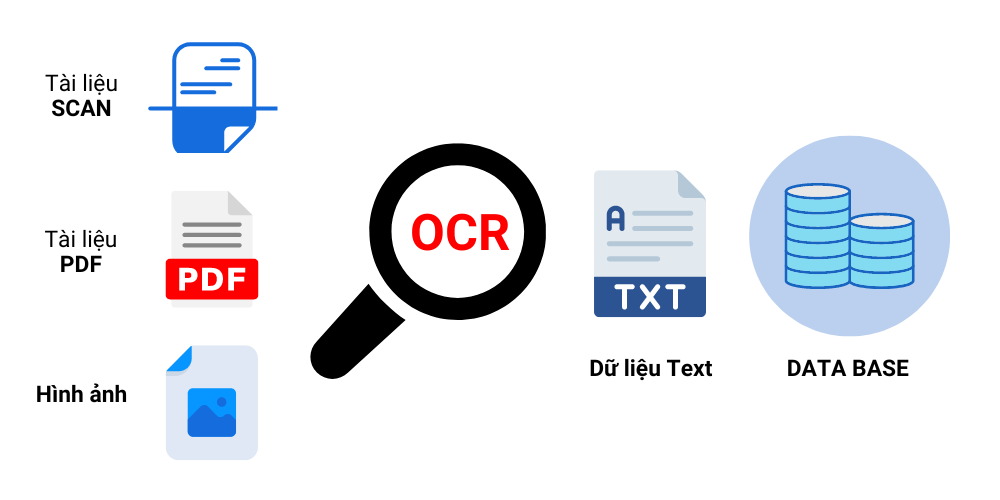

OCR (Optical Character Recognition) is a technology that converts characters from images, PDF files, and scanned documents into machine-readable text. OCR is widely recognized as a powerful tool for identifying and reading text, then extracting and storing it in a digital, editable format—thus enabling document digitization.

Businesses that apply OCR technology in processing bank statements have effectively overcome the inherent challenges of traditional methods. Once a PDF file or scanned image of the statement is uploaded, the system will automatically recognize all key information fields — including typed text, handwritten text, numbers, signatures, stamps, checkboxes, and more.

From there, it accurately extracts the data into editable formats for storage or further processing, depending on the customer's needs, instead of relying on manual data entry.

Nowadays, the quality of OCR technology is continuously improving, offering exceptionally high accuracy in reading information. For repetitive tasks like these, machines not only work faster but also more efficiently, ensuring the quality of critical data and minimizing human errors. Human resources can then be optimized and redirected toward creative and high-level thinking tasks.

3. OCR Studio – A Leading Document Digitization Solution for Banks

With the capability to automatically extract and populate data fields, OCR is extensively applied in the field of document digitization. At GMO-Z.com RUNSYSTEM, our team of top economics and technology experts has developed OCR Studio, an intelligent document digitization solution.

This tool enables banks to digitize paper documents with up to 99% accuracy, significantly saving time and costs, and delivering the highest return on investment.

99% Accuracy, Industry-Leading Handwriting Recognition

Not only does OCR Studio ensure accurate text recognition from standard, well-formatted documents, but it is also the only solution on the market capable of recognizing elements such as stamps, signatures, checkboxes, and handling complex backgrounds caused by colors, stamps, and tables.

Most notably, OCR Studio is the only solution in the market capable of recognizing Vietnamese handwriting for real-world business applications—meeting the custom operational requirements of enterprises.

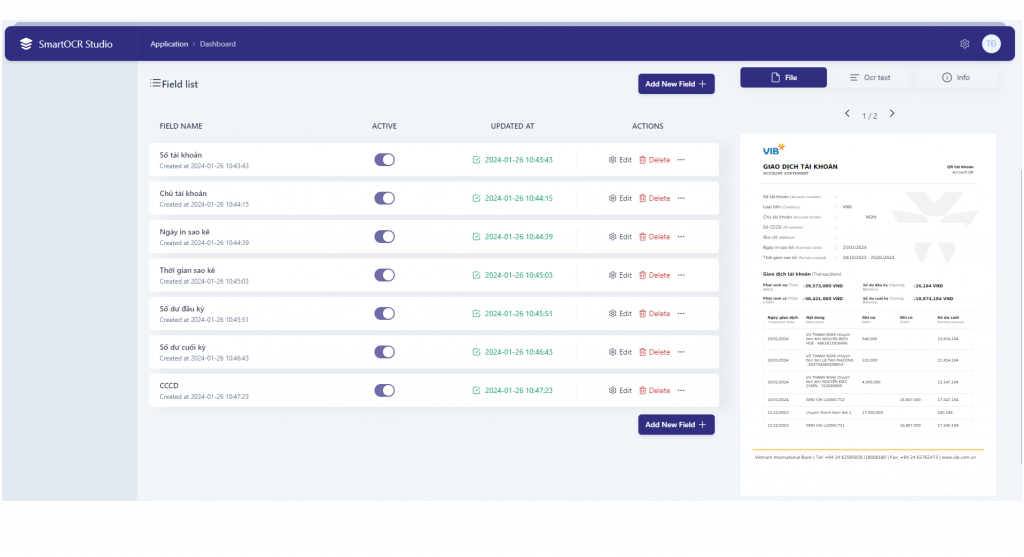

Flexible Data Extraction to Meet Practical Business Needs

OCR Studio allows flexible extraction of information fields based on specific business needs and supports post-validation of data. Even non-technical users can easily define and configure fields for extraction.

With a built-in App Store containing over 50 ready-to-use document templates, businesses can instantly extract data without the need to reconfigure or define new templates.

In addition, OCR Studio includes unique features unavailable from other vendors, such as:

- Dictionary: a data normalization tool used for specific fields in documents.

- Standardized data integration: Ensures seamless compatibility with external systems like ECM or other enterprise data platforms.

- Asynchronous document processing: Designed for organizations handling massive document volumes. The system allows users to upload all files at once and processes them efficiently, even with mismatched or unordered documents.

Proven Implementation Excellence

With 20 years of experience in software development and providing IT solutions and services to both the Vietnamese and Japanese markets, we are confident in delivering high-quality solutions with dedicated support.

OCR Studio has been trusted by hundreds of major clients, including:

- Shinhan Bank

- Southeast Asia Commercial Joint Stock Bank (SeABank)

- Cathay Vietnam Non-life Insurance Co., Ltd.

- Toyota Finance, and many more.

Discover how Shinhan Bank accelerated customer document processing using OCR technology

Contact Us

If you're interested in our solution, please reach out to our expert team for a personalized consultation.

Smart Solutions – The Digital Transformation Ecosystem

Digital Transformation Division – GMO-Z.com RUNSYSTEM

🌐 Website: https://ssolutions.vn/

📘 Facebook: https://www.facebook.com/ssolutions.dx

📞 Hotline: 097 583 0096

📍 Locations: Hanoi – Hue – Da Nang – Ho Chi Minh City – Tokyo