Fraud detection technology safeguards eKYC from cybercrime

Online account opening through eKYC (electronic Know Your Customer) has significantly shortened the verification process, especially during the Covid-19 pandemic. However, as digital banking continues to evolve, cyber fraud has become increasingly sophisticated, requiring eKYC solutions to deliver higher levels of security and reliability.

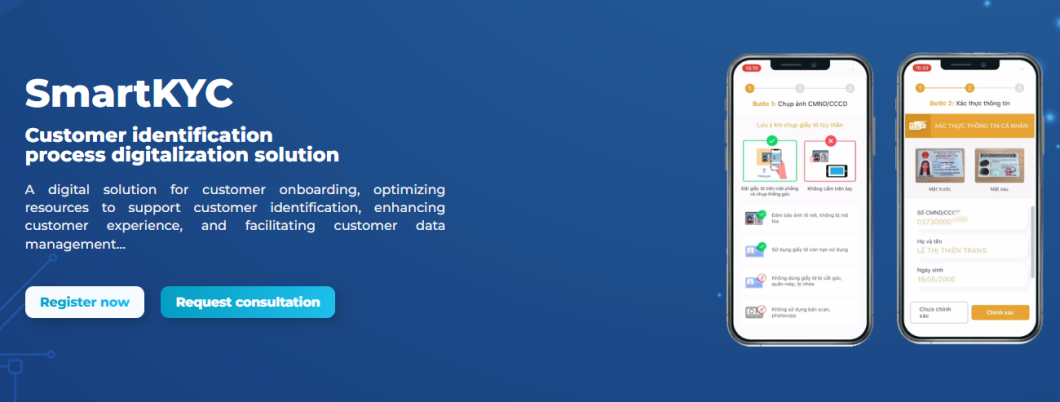

According to Mr. Nguyen Tan Minh - Deputy General Director of GMO-Z.com RUNSYSTEM, advancements in artificial intelligence (AI) and Liveness Detection technology have created new possibilities to prevent identity fraud. The company’s SmartKYC solution integrates both Active Liveness (prompting users to perform random actions to prove they are real) and Passive Liveness (automatically analyzing and distinguishing fake photos or videos). The system can detect over 30 types of forgery indicators on documents and faces, helping businesses proactively mitigate risks.

Built on three key modules: module OCR (SmartOCR - Top 10 Sao Khue 2019 award-winner with 99% OCR accuracy), Fraud Detection, and Facial Verification - SmartKYC is capable of recognizing the same face captured up to 15 years apart and searching a database of 10 million faces in under three seconds, enabling rapid identification of individuals on “blacklists.”

With more than 16 years of experience in financial and banking technology, GMO-Z.com RUNSYSTEM has successfully deployed SmartKYC for major institutions such as Bac A Bank, MB Bank, Toyota Finance, and Cathay Life, strengthening trust, security, and compliance in digital identity verification processes.